Interest Only Mortgage Deals

Saturday 22 October, 2022

Interest only mortgages may be able to help lower your monthly payments as you are not repaying the capital of the loan. In order to repay the mortgage, you can use a repayment plan which could include savings or other capital assets you may already own.

With the Bank of England continuing to raise the interest rates, the knock-on effect to mortgages is now showing that taking an interest only mortgage can suit some people’s finances to improve their monthly budgets.

It is always possible to review your mortgage to determine if there are other options available to you. We strongly recommend you call our mortgage broking team on 01707 872000 to help determine if you have the best mortgage rate and most suitable mortgage product for your circumstances.

Please note that the actual mortgage rates available will depend on your individual financial circumstances and that mortgage rates illustrated below are only available for a certain length of time. However, we can check the market and provide you with the best available rate when you a Thomas Oliver mortgage broker.

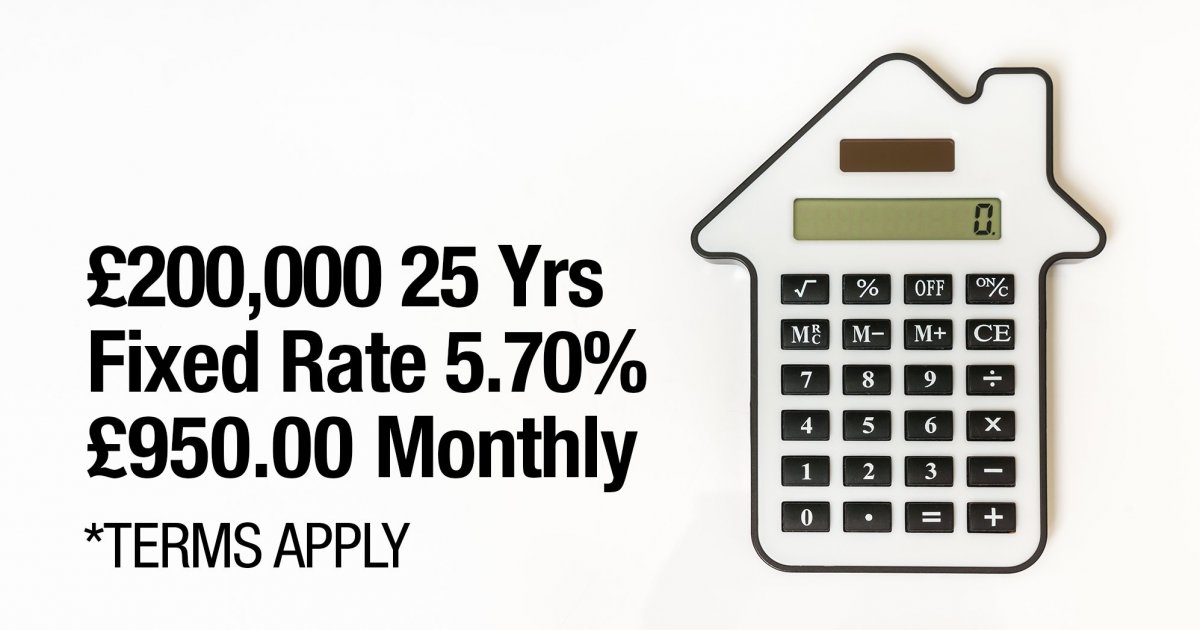

Mortgage Deal – Option 1

£200,000 loan with a 25-year term

Fixed Rate of 5.70% until 31.12.2024

Monthly Payment £950.00

Early repayment charges will apply until 31.12.2024

The overall cost for comparison is 5.3% APRC

For an interest only mortgage you would pay 26 payments at a cost of 5.70% with monthly payments of £950.00, followed by 274 payments at a variable rate which is currently 4.99% with monthly payments of £831.67 Total amount payable £453,742.

The illustration is based on an interest only mortgage.

Mortgage Deal – Option 2

£250,000 loan with a 25-year term

Fixed rate of 5.70% until 31.12.2024

Monthly Payment £1,187.50

Early repayment charges will apply until 31.12.2024

The overall cost for comparison is 5.2% APRC

For an interest only mortgage you would pay 26 payments at a cost of 5.70% with monthly payments of £1,187.50, followed by 274 payments at a variable rate which is currently 4.99% with monthly payments of £1,039.58. Total amount payable £566,884.

Please note if you are reading this this after 18/10/2022 it is possible that these rates may no longer be available.

Our Mortgage Services

Thomas Oliver provides mortgage advice for the following services:

- Mortgages

- Remortgages

- Product Transfer

- Further Advances

- Interest Only Mortgages

- Repayment Mortgages

- Variable Mortgages

- Tracker Mortgages

- Fixed Mortgages

Rafi Khan - Mortgage Broker in East Ham, London said:

“As the cost of living rises and mortgage rates with them, it is only natural that people look for ways to reduce their monthly expenditure to help cover all their outgoings. An interest only mortgage may offer a solution for some people and consideration should be given to this option.

I would like to stress though, seeking professional mortgage advice first will be vital to securing a mortgage deal that fits with your specific circumstances.

If this sounds familiar to you then I would strongly recommend calling us on 01707 872000, so we can find the most suitable mortgage product for you.”

Your property may be repossessed if you do not keep up repayments on your mortgage. Thomas Oliver UK LLP are appointed representatives of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.